In the ever-evolving landscape of alternative investments, a remarkable trend is emerging that's reshaping how capital flows through private markets: the explosive growth of secondaries. As someone who's been both an investor and operator in this space, I've watched this transformation with great interest - particularly as it relates to democratizing access to alternatives.

The Liquidity Revolution

For decades, private equity has been characterized by its illiquid nature - a "buy and hold" strategy where capital remains locked up for 10+ years. This fundamental characteristic is now changing before our eyes. Private equity is no longer a buy and hold strategy. The limited partner (LP) market is poised for continued growth as a key source of liquidity for investors, while the general partner (GP) market offers an attractive opportunity set and alternative exit path for sponsors.

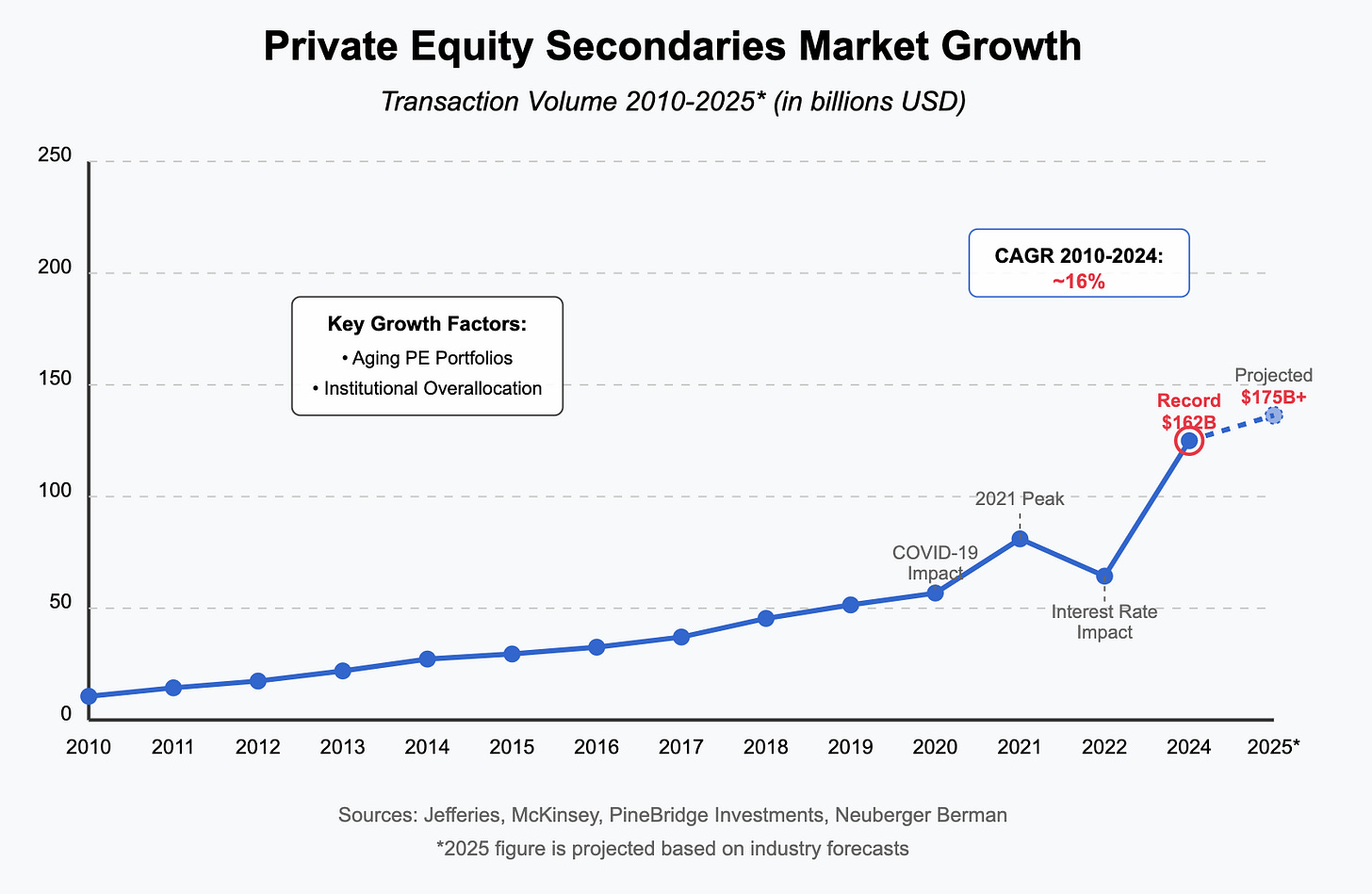

The numbers tell a compelling story. According to Jefferies' market review, secondaries transaction value rose an astounding 45% to reach an all-time high of $162 billion in 2024. This isn't just incremental growth - it represents a fundamental shift in how private markets operate.

What is a secondary?

In private markets, a secondaries are transactions that involve the buying and selling stakes of illiquid closed-end investments funds or direct investments. Generally, these shares are sold by initial investors or employees. Common in private markets among early stage, venture backed companies, secondaries afford shareholders liquidity when they wouldn’t otherwise have it. Several platform

Why Now? The Perfect Storm

This explosive growth isn't happening by accident. Several factors have converged to create ideal conditions for the secondaries market:

The Liquidity Squeeze: Providing liquidity and returning capital remains a top priority for the industry in 2025. While exits have started to pick up, firms and investors are increasingly taking advantage of alternative liquidity solutions. With traditional exit routes (IPOs and M&A) constrained over recent years, capital allocators are desperate for liquidity.

Aging Portfolios: General Partners face pressure to exit and return Limited Partner capital as almost one-third of U.S. buyout-backed companies have been held for 5+ years. These extended holding periods have created a backlog that secondaries can help clear.

Institutional Overallocation: The "denominator effect" (where private assets become overweighted in portfolios as public market valuations fall) has pushed many institutions to seek rebalancing through secondary sales.

Maturing Market Infrastructure: The ecosystem supporting secondaries has evolved dramatically, with specialized funds, improved pricing mechanisms, and standardized processes making transactions more efficient.

A Glimpse Into the Future

Looking ahead, I'm convinced we're just at the beginning of this transformation. According to PineBridge research, the value of secondary transactions may triple over the next seven years, from $114 billion in 2023 to $417 billion in 2030. This trajectory aligns with my thesis that capital allocators will increasingly demand liquidity for assets that have extended beyond their intended investment periods.

Perhaps most telling is how secondaries have become a critical component of the private equity ecosystem. In 2024, secondary volume represented approximately 20% of total global PE exit activity - a staggering increase from the 10-year average of 10.4%. This underscores the increasingly vital role secondaries play in providing liquidity to the market.

The Democratization Connection

How does this connect to democratizing alternative investments? The growth of secondaries addresses one of the fundamental barriers that has kept alternatives largely confined to institutional investors: the liquidity problem.

As BlackRock's Larry Fink recently noted in his annual letter, there's growing recognition that "assets that will define the future — data centers, ports, power grids, the world's fastest-growing private companies — aren't available to most investors. They're in private markets, locked behind high walls."

Wall Street Giants Race to Democratize Private Markets

The financial landscape is witnessing an unprecedented push by Wall Street's most powerful firms to democratize access to private markets, with Apollo Global Management, BlackRock, and Goldman Sachs leading the charge.

Apollo: Engineering New Access Points

Apollo Global Management has been at the forefront of this democratization trend, with CEO Marc Rowan directly championing efforts to make private markets accessible to a wider range of investors. In September 2024, Apollo partnered with State Street Global Advisors to expand investor access through ETFs and other investment vehicles. As Anna Paglia of State Street noted, they are working with Apollo to "democratize access to private asset exposures through ETFs and other investment products... making them more accessible to a wider swathe of investors".

In February 2025, Apollo took this vision further by forming a founding partnership with InvestCloud to activate the Private Markets Account Network, which "combines public and private assets within a single, unified platform" to further democratize access.

BlackRock: Transforming Its Identity

BlackRock, long known as a traditional asset manager, is undergoing a profound identity shift. In his 2025 annual letter, CEO Larry Fink emphasized that "BlackRock has always had a foot in private markets but we've been – first and foremost – a traditional asset manager. That's who we were at the start of 2024 but it's not who we are anymore".

Following acquisitions of Global Infrastructure Partners, HPS Investment Partners, and Preqin totaling over $27 billion, BlackRock is positioning itself to lead what Fink calls the "final stage of market democratization" - a process he argues has been unfolding for 400 years. For BlackRock, private markets democratization isn't just a business strategy; it's become central to the firm's vision of the future financial system.

Goldman Sachs: Opening the Private Equity Gates

Not to be outdone, Goldman Sachs has just announced the launch of G-PE, an open-ended private equity fund that "will offer access to deals from its buyout, growth, secondary and co-investment strategies". This new vehicle allows wealthy individuals to access private equity opportunities that were previously restricted to institutional investors.

Goldman's head of alternatives for wealth, Kristin Olson, explained the strategic rationale: "As more companies opt to stay private for longer and a greater share of economic growth occurs in private markets, investors will need to look beyond the public markets". The firm plans to aggressively grow this business, aiming to increase alternative investment distribution via third-party wealth platforms from $5 billion in 2024 to $8 billion in 2025.

The Wealth Transfer Dynamic: From Institutions to Retail

This democratization trend creates an intriguing dynamic in the market. As institutional investors seek liquidity through secondaries to rebalance their portfolios or meet cash flow needs, they're effectively transferring ownership of these assets to a new class of less sophisticated investors.

The question becomes: are retail investors getting access to the "crown jewels" of institutional portfolios, or are they becoming the buyers of last resort for assets that sophisticated players are eager to offload?

The reality likely falls somewhere in between. Institutional investors facing liquidity pressures will naturally prioritize selling assets they consider appropriate for liquidation - those that have either already delivered substantial returns or those they view as less likely to outperform in the future. Yet this doesn't necessarily mean retail investors are getting a raw deal. Many of these assets remain fundamentally sound investments that simply no longer fit the time horizon or strategic objectives of the original owners.

What's clear is that the growing secondaries market creates this transfer mechanism between institutional and retail capital. As the market expands from $162 billion in 2024 to a projected $417 billion by 2030, we'll witness one of the most significant wealth transfers in financial history - from the balance sheets of institutions to the portfolios of individual investors.

As the secondaries market expands, we're seeing the development of more accessible structures that can bring these investments to a broader audience. Goldman Sachs' recent launch of an open-ended private equity fund named G-PE is just one example of how traditional barriers are being reimagined.

What This Means For Investors

For investors at all levels, the implications are significant:

Portfolio Management Flexibility: LPs are becoming more tactical in managing their portfolios and are using secondaries to fine-tune their exposures, while GPs increasingly see the secondaries market as an attractive means for harvesting liquidity from their star-performing companies while remaining invested in them.

Access to High-Quality Assets: As continuation vehicles and other GP-led secondaries grow, investors gain opportunities to access proven assets with established track records.

Smoother Return Profiles: The ability to buy into partially mature portfolios can reduce the "J-curve" effect, where returns are negative in early years.

Lower Barriers to Entry: As structures evolve to accommodate secondaries, minimum investment thresholds are often lower than in primary fundraising.

The Road Ahead

While challenges remain - including concerns about potential return degradation as more capital chases deals - the trajectory is clear. The secondary market remains both undercapitalized and under-resourced. While volume reached $114 billion in 2023, secondaries comparatively make up just a fragment of the overall private equity market, which has $13.1 trillion of assets under management. There's substantial room to grow.

In my view, we're witnessing not just a financial innovation but a structural evolution that will permanently reshape alternative investments. The ability to create liquidity where it previously didn't exist is transforming private markets from exclusive clubs into more dynamic, accessible ecosystems.

For savvy investors who understand this transformation, the opportunities are substantial - both in terms of gaining access to previously unavailable assets and in capitalizing on the inefficiencies that still exist in this rapidly evolving market.

The walls around private markets aren't coming down entirely, but significant gateways are opening. The rise of secondaries isn't just about providing exit routes for the existing elite - it's about creating entry points for the next generation of alternative investors.

The Perfect Storm: How Trump's Tariffs Will Accelerate the Secondaries Surge

As we look to the remainder of 2025 and beyond, the secondaries market appears poised for unprecedented growth – and President Trump's sweeping tariff policies may be the catalyst that sends this already booming market into overdrive.

The global economy has been rocked by the implementation of Trump's reciprocal tariffs, which have triggered significant market volatility and raised serious concerns about economic growth. The IMF is already planning a downward "correction" to its 2025 forecast of 3.3% global growth Reuters, while Goldman Sachs economists estimate these tariffs could imply a 0.7% increase in core inflation and a 0.4% hit to GDP Reuters.

For institutional investors already grappling with aging portfolios and overallocation challenges, this economic uncertainty creates the perfect storm of conditions that will likely accelerate secondaries transactions:

Heightened Liquidity Pressure

With the S&P 500 having lost $4 trillion in value since Trump began implementing tariffs (Reuters), institutional investors are seeing their liquid assets decline significantly. This denominator effect forces many institutions into even more severe overallocation to private markets. As these investors scramble to rebalance portfolios, the secondaries market provides the most efficient escape valve.

Increased Economic Uncertainty

The macroeconomic uncertainty created by tariffs dramatically changes the risk calculus for institutional investors. Prolonged tariffs "could hurt growth and add to inflation, leaving the Federal Reserve limited flexibility in their policy rate decisions" meaning investors can no longer count on lower interest rates to stimulate economic growth and exit opportunities. This uncertainty will push many investors to seek liquidity now rather than gamble on future conditions.

Extended Hold Periods

As the tariff situation dampens M&A activity and IPO prospects, the already extended hold periods for portfolio companies will likely stretch even further. With Trump's tariffs projected to increase the average tariff rate to 18.8% – the highest since 1933 – and reduce imports by 28%, many exit avenues for portfolio companies will narrow considerably, particularly for businesses with global supply chains or significant international exposure.

What This Means for the Secondaries Market

The convergence of these factors will likely trigger what could be described as a "flight to liquidity" among institutional investors. With traditional exit routes compromised and portfolio rebalancing necessities becoming more urgent, we anticipate the secondaries market could reach volumes of $200-250 billion annually by 2027 – much sooner than previous projections suggested.

For well-capitalized investors positioned to acquire these assets, the next 12-24 months may present the most attractive buying opportunity in the secondaries market's history. Quality assets will become available at increasingly favorable discounts as institutional sellers prioritize speed and certainty of execution over maximizing price.

The democratization trend discussed throughout this article – led by Apollo, BlackRock, and Goldman Sachs – couldn't be more perfectly timed. As institutional capital seeks exits through secondary sales, these financial giants are building the infrastructure to distribute these assets to a broader investor base. The wealth transfer from institutions to individual investors through secondaries vehicles may well become one of the defining financial shifts of this decade.

As the old Wall Street adage suggests, the best returns are made not when skies are clear, but when uncertainty reigns and liquidity commands a premium.